Today we want to show the most sophisticated Institutional algorithms that is used by large institutional clients for market-making, order execution and trading.

EXECUTION ALGORITHMS FOR MAKING LESS IMPACT TO MARKET

Iceberg (Iceberg)

An algorithm that dispenses orders . Of the true order quantity, only a part is shown on the board, and when the order placed on the board is executed, the next order is placed.

Stealth

Don't put your order on the board, but take it when you get an order for the price you want to buy on the board.

Pegging

An algorithm that places a limit order that is a certain value or a certain percentage away from the best quote, and follows it when the best quote fluctuates . Sometimes used for market making.

Layering

Place limit orders distributed across multiple prices in order to take a high priority position within each price .

Liquidity Driven Order

Monitor the liquidity of the board and place an order when the liquidity exceeds a certain level.

SOR (Smart Order Rouiting)

Place orders from multiple markets to the best market.

BENCHMARK EXECUTION ALGORITHM-AN ALGORITHM THAT BRINGS THE EXECUTION RESULT CLOSER TO SOME KIND OF BENCHMARK USED BY INSTITUTIONAL INVESTORS FOR LARGE ORDERS.

TWAP (Time-Weighted Average Price)

An algorithm that equalizes in time and places an order . Place an order by dividing the quantity you want to trade at equal time intervals.

VWAP (Volume-Weighted Average price)

An algorithm that aims to bring your VWAP closer to the market VWAP . In many cases , the volume is normalized by the volume distribution during the day and the quantity is sliced before ordering.POW

POV(Percentage of Volume)

Place an order so that it accounts for a certain percentage of the market volume .

PI (Price Inline)

A modified version of VWAP. If the current price is smaller than VWAP, order a larger quantity, and if it is larger, order a smaller quantity.

MOC (Market on Close)

An algorithm that aims to bring its VWAP closer to the closing price of the market .

IS (Implementation Shortfall)

An algorithm that benchmarks the market price at the time of buying and selling decisions .

MARKET MAKING ALGORITHM-ALGORITHM USED FOR MARKET-MAKING . PLACE BOTH BUY AND SELL ORDERS ON THE BOARD.

See market mid-market price

Determine your order price by referring to the market mid-market price.

Market price interlocking

Take the limit order left behind when the board situation changes and the price moves to either side .

Utilization of market liquidity

If there is a large order for another participant on the board, place an order in front of it.

ARBITRAGE ALGORITHM-MAKE RULING BY PAYING ATTENTION TO THE DISTORTION OF THE MARKET.

Same product arbitrage

If the same product is traded in multiple markets, the price difference is determined.

Theoretical ruling

For objects such as derivatives for which the theoretical price can be calculated according to a model such as the financial price, the price difference from the theoretical price is determined.

Statistical ruling

Arbitrate statistical distortions that other market participants are unaware of.

DIRECTIONAL ALGORITHM-PREDICT PRICE MOVEMENTS AND ACTIVELY TAKE MARKET RISK.

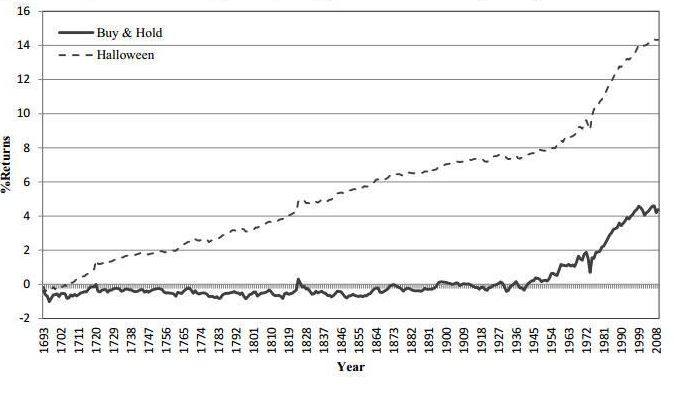

Trend Following

We will trade with the expectation that the trends that occurred at the past will continue in the future.

Momentum Traing

Make transactions that take advantage of short-term momentum.

MEAN REVERSION-TRADE THE HOPE THAT THE PRICE WILL RETURN TO EQUILIBRIUM WHEN THE PRICE FLUCTUATES TOO MUCH.

Range Trading

Trade with the expectation that the price will move within a certain range.

News / Event Driven

Transactions are triggered by stock price movements such as corporate news and announcements of indicators.

MARKET OPERATION ALGORITHM-AIM TO MANIPILATE THE MARKET BY INDUCING THE OTHER PARTICIPANTS. IT MAY CONTAIN ILLEGAL ELEMENTS.

Front Running

The broker uses the order information from the customer to buy and sell in his own favor .

Spoofing

Place large orders at multiple prices and mislead other investors' forecasts.

Strike robbing (Strobing)

Placing an order on the board for a moment misleads other participants' predictions.

Momentum Ignition

Placing an order in a specific direction misleads other participants' predictions.

Stop Loss Ignition

Induce price movements by aiming for stop loss orders from other investors.

Push the Elephant

When there is a large order on the board that seems to be willing to buy or sell, induce a large order by updating the best quote with your own order.

Gaming

Update the best quote on your order and manipulate the price of the dark pool referring to the quote.